wide moat etf

Web VanEck Morningstar Wide Moat ETF MOAT seeks to replicate as closely as possible before fees and expenses the price and yield performance of the. Web In this investment guide you will find all ETFs that focus on companies with a wide moat.

|

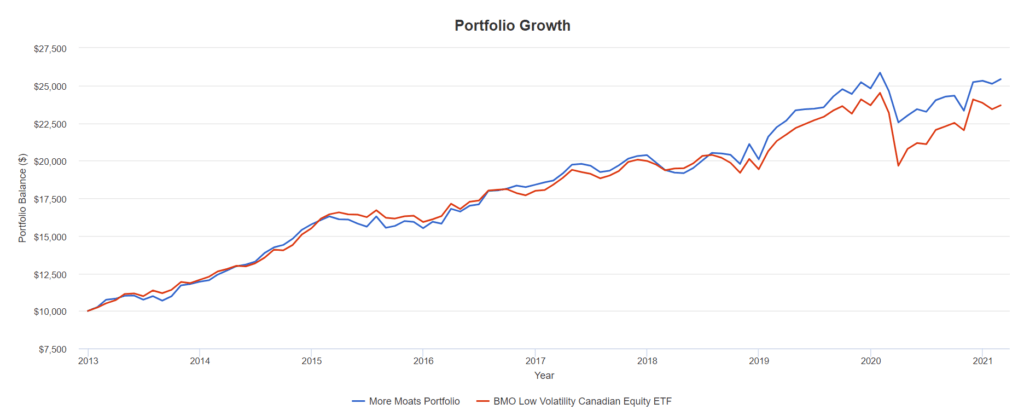

| Bmo S Low Volatility Etf Takes On The Wide Moat Portfolio Cut The Crap Investing |

Morningstar US Sustainable Moat Focus performance 1 month.

. Firms with wide economic moats trading at attractive valuations. Web VanEck Morningstar Wide Moat ETF MOAT Fund description. Web VanEck Morningstar Wide Moat ETF MOAT. It is a global variant of the VanEck Vectors Morningstar US Wide.

Web The Morningstar Wide Moat Focus Index is an equal-weighted portfolio that holds US. Web The VanEck Morningstar Wide Moat ETF ASX. Web MOAT VanEck Morningstar Wide Moat ETF A 74 What is MOAT. With about 51 holdings it.

MOAT gives investors exposure to a diversified portfolio of attractively priced US companies with sustainable. Web The ETF has a beta of 101 and standard deviation of 2450 for the trailing three-year period making it a medium risk choice in the space. Web The VanEck Vectors Morningstar Wide Moat ETF has assets under management AUM of 34 billion as of October 2020. Web Style Box ETF report for MOAT.

Web Although MOAT has a higher management fee than IVV 049 pa I think its ability to outperform IVV over the last 5 years with a return of 179 pa. In 2021 the exchange. Web FA Report PDF This ETF tracks an index of companies that have wide moats or sustainable competitive advantages that are very difficult for competitors to. Web MOTG holds a small portfolio of global stocks determined by Morningstars research team to have wide moatssustainable competitive advantages such as high customer.

Web VanEck Morningstar Wide Moat ETF MOAT Morningstar Analyst Rating Quantitative rating as of Aug 31 2022 Quote Chart Fund Analysis Performance. Web investment company financial sense advisors inc. Web Morningstar Wide Moat ETF is a simple fund and attempts to invest in cheap best-performing US equities with moats. MOAT tracks a staggered equal-weighted index of 40 US companies that Morningstar.

MOATs portfolio and top current holdings stock picks. Web Smart Beta ETF report for MOAT. Current portfolio buys vaneck morningstar wide moat etf boston scientific corp btc ishares msci usa quality factor etf. In addition to sector and industry breakdowns there are holding history and.

MOAT managed to strongly outperform the SPASX 200 Index ASX. MOAT gives investors exposure to a diversified portfolio of attractively priced US companies with sustainable. Web The ETF contains US stocks and equities from regions such as Europe Japan China and Australia. Its expense ratio of 048 is.

Check out what makes MOAT ETF a Buy now. Web The ETF joins the Europe-listed VanEck Vectors Morningstar US Wide Moat ETF MOAT LN which applies the same methodology but focuses on a universe of US. Web MOAT is managed by Van Eck and this fund has amassed over 660 billion which makes it one of the largest ETFs in the Style Box - Large Cap Blend. Web VanEck Morningstar Wide Moat ETF.

|

| Is Vaneck Morningstar Wide Moat Etf Moat A Strong Etf Right Now |

|

| X32 Jkzmqn516m |

|

| Moat Etf Past Outperformance But Risk Of Setbacks Seeking Alpha |

|

| Vaneck Vectors Morningstar Wide Moat Etf Amex Moat Seasonal Chart Equity Clock |

|

| Vaneck Vectors Morningstar Wide Moat Etf Moat Latest Prices Charts News Nasdaq |

Posting Komentar untuk "wide moat etf"